Benefits of Partner with iSaral

- Unconditional Support

- Referral Bonus on every Reference

- Recurring Bonus – iSaral Providing you recurring Bonus on purchase of any other service from your Referred Customers.

| Quantity | Fixed price |

|---|---|

| 1 – 4 | ₹500.00 |

| 5 – 9 | ₹400.00 |

| 10 – 24 | ₹325.00 |

| 25 – 49 | ₹310.00 |

| 50 – 74 | ₹300.00 |

| 75 – 99 | ₹290.00 |

| 100 – 1000 | ₹280.00 |

+ 18 % Tax

| Quantity | Fixed price |

|---|---|

| 1 – 4 | ₹500.00 |

| 5 – 9 | ₹400.00 |

| 10 – 24 | ₹310.00 |

| 25 – 49 | ₹295.00 |

| 50 – 74 | ₹285.00 |

| 75 – 99 | ₹275.00 |

| 100 – 1000 | ₹265.00 |

+ 18 % Tax

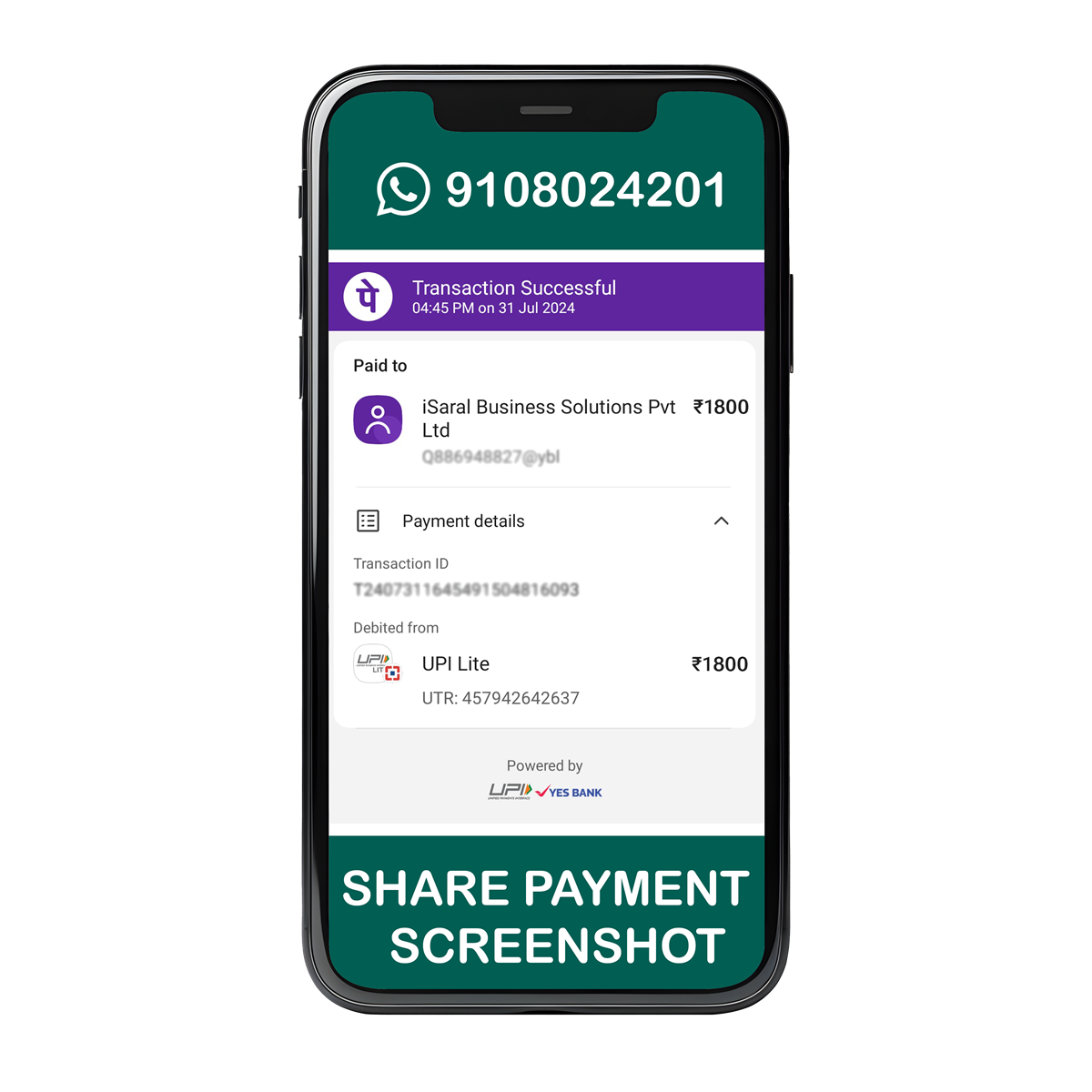

Payment Process

Step 1

Step 2

Required Documents For Organisation Digital Signature

| Documents Name | Proprietorship | Partnership | Pvt Ltd/Ltd Company | LLP | AOP/BOI | NGO/Trust | |||

|---|---|---|---|---|---|---|---|---|---|

| Applicant Photo |  |

|

|

|

|

|

|||

| Copy of Applicant PAN Card |  |

|

|

|

|

|

|||

| GST Certificate |  |

|

|

|

|

|

|||

| Copy of Recent Bank Statement / Bank Certificate, If GST Certificate Not Available |

|

|

|

|

|

|

|||

| Copy of Organizational PAN Card, If GST Certificate Not Available |

|

|

|

|

|

||||

| Copy of Business Registration Certificate (S&E / etc) If GST Certificate Not Available |

|

||||||||

| Copy of Partnership deed containing list of Partners / Authorization Letter

If an Authorized signatory is not a director, the Board Resolution with an authorization letter |

|

||||||||

| Authorized Signatory ID Proof (Organizational ID Card / PAN Card / etc) |  If Applicant is not proprietor |

|

|

|

|

|

|||

| Proof of Authorized Signatory (List of Directors / Board Resolution / Resolution) |  |

|

|

|

|||||

| Copy of Incorporation Certificate, If GST Certificate Not Available |

|

|

|

|

|||||

| Note : Mail id & Mobile Number is Mandatory | |||||||||